option to tax form

Get a Copy of a Tax Return. Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3.

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

VAT1614C revoking an option to tax six-month cooling.

. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. Section 1256 of the Internal Revenue Code allows more favorable tax treatment for futures traders versus equity traderswith that the maximum total tax. If they subsequently sell back the option when Company XYZ drops to 40 in September 2020 they.

If you must file you have two options. Sign Online button or tick the preview image of the form. Report options-related transactions on Internal Revenue Service Form 8949 and Form 1040 Schedule D along with your other investment transactions.

This year in response to the COVID-19 pandemic the filing deadline and tax payment due date was postponed from April 15 to July 15 2020. Based on comments received on the public drafts of the 2022 Form W-4P and the 2022 Form W-4R regarding the time required by payers to implement the new forms the IRS has postponed the requirement to begin using the redesigned Form W-4P and the new. You do not need to do any tax reporting on the option premium until the contract is exercised sold or expires.

To complete the loop there are three other forms that are used in limited situations which are mainly relevant to entities with a large portfolio of properties. Filing an electronic tax return often called electronic filing or e-filing or. File Form 1040-X to.

Filing a paper tax return. Form Disapply the option to tax land sold to housing associations. 1 day agoThe Internal Revenue Service announced today that more forms can now be amended electronically.

10 June 2022 Form Revoke an option to. Learn how to get each one. Get Copies and Transcripts of Your Tax Returns.

8 October 2014 Form Apply for permission to opt to tax land or buildings. To get started on the form use the Fill camp. Each year you need to decide which filing method is right for you.

VAT1614C - revoking an option to tax within 6 month cooling off period Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period. But if you own multiple properties you can limit the option to tax a letting to one property or specified properties. The W-2 box 12 codes are.

Paper filing is still an option for Form 1040-X. Until you sell the unites you dont have to enter information from Form 3921 into your tax return. Information returns may also be filed electronically using the IRS Filing Information Returns.

Since you have not sold the stock the holding period requirements have not been determined. When you exercise an incentive stock option ISO there are generally no tax consequences although you will have to use Form 6251 to determine if you owe any Alternative Minimum Tax AMT. Download your states tax forms and instructions for free.

What are w2 Box 12 codes. Click on Employer and Information Returns and well mail you the forms you request and their instructions as well as any publications you may order. Filing and Payment Deadlines page.

Payers have the option to use either the 2021 Form W-4P or the 2022 Forms W-4P andor W-4R for 2022. The IRS and all other applicable copies of the form visit wwwIRSgovorderforms. Form 3922 is issued for employee stock options that you purchased but do not sell.

You may need a copy or a transcript of a prior years tax return. Call HMRC for help on opting to tax land or buildings for VAT purposes. Change amounts previously adjusted by the IRS.

Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422b. State Tax Forms. When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422b which provides the information needed for tax-reporting purposes.

VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject. Mail the following items to get an exact copy of a prior year tax return and attachments. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and.

A completed Form 4506. Correct Form 1040 1040-SR or 1040-NR or older filings of Form 1040-A 1040-EZ or 1040-NR-EZ. The letting of a property is exempt from Value-Added Tax VAT.

Use this form only to notify your decision to opt to tax land andor buildings. Make certain elections after the deadline. Save this form with your investment records.

A list of forms due July 15 is on the Coronavirus Tax Relief. VAT1614B ceasing to be a relevant associate in relation to an option to tax. This form will report important.

Taxpayers have a variety of options to consider when paying federal taxes. If you opt to tax a letting you will have to register and pay VAT on the rents from. E-filing is generally considered safer faster and more convenient but some people cant e-file and must mail their tax returns to the IRS.

However as a landlord you can opt to tax the letting of certain properties. You can opt to tax one property at a time or all of the properties you own its your choice. Make a claim for a carryback due to a loss or unused credit.

These include people filing corrections to. Form for Notification of an option to tax Opting to tax land and buildings on the web. You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC.

Opting to tax is quite easy. The advanced tools of the editor will guide you through.

Incentive Compensation Plan Template Lovely Performance Incentive Pensation Plan Template Incentives For Employees How To Plan Incentive

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two O Tax Return Singapore Filing Taxes

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

Income Tax Return Update Financepost In 2021 Finance Blog Finance Income Tax Return

W 11 Form Completed How I Successfully Organized My Very Own W 11 Form Completed Form Example Job Application Template Standard Form Math

Tips For Buying Tax Exempt Textbooks Textbook Tax Tips

Checklist For Acquisitions 3 Real Estate Forms Writing A Book Review Lettering

Invest In Nps Investing Digital India How To Plan

K9 Tax Form Taxes Humor Income Tax Humor Income Tax

Pin By Olivia Reyes On Pta Donation Letter Pto Fundraiser School Pto

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Irs Tax Forms Student Loan Interest

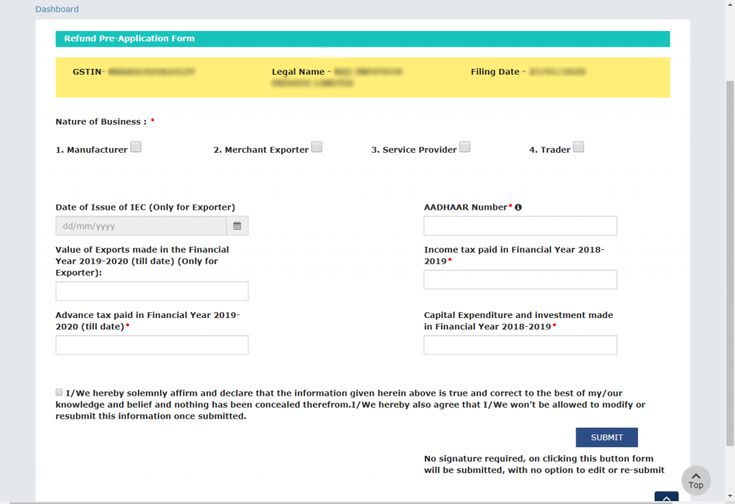

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Business Accounting Software Tax Forms

1040 Form For Your Dog Taxes Humor Income Tax Humor Income Tax

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Tax Due Dates Stock Exchange Due Date Tax

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software